### Handling Legal Documents When a Family Member’s Capacity Begins to Wane

As our loved ones age, it’s common for their mental and physical abilities to decline. This can lead to a situation where they are no longer able to manage their own affairs, a condition known as incapacity. Handling legal documents during this time is crucial to ensure that their wishes are respected and their well-being is protected. Here’s a simple guide to help you navigate this complex process.

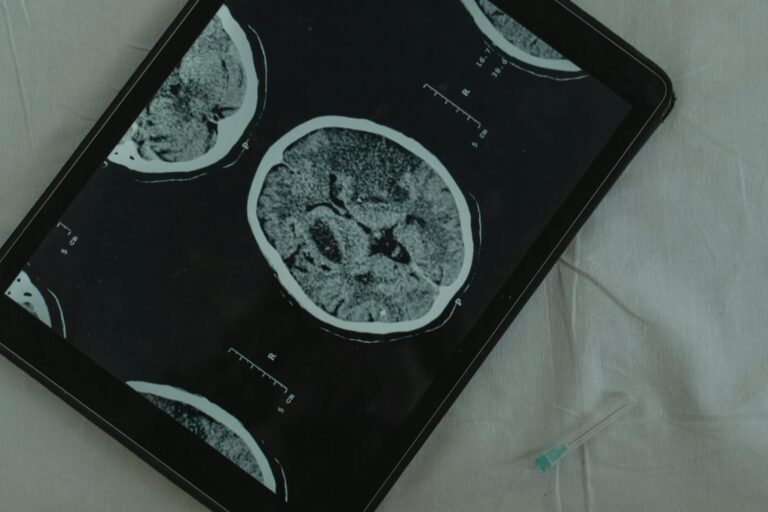

#### Understanding Incapacity

Incapacity occurs when a person is unable to take care of themselves due to a serious mental impairment. This can include conditions like dementia or Alzheimer’s disease. The key signs of incapacity include:

– **Understanding and Communication:** The person is unable to understand or communicate with others.

– **Recognition:** They are unable to recognize people or things that were once familiar.

– **Consequences:** They do not understand the consequences of their actions.

– **Delusional Thoughts:** They have delusional thoughts or hallucinations.

– **Mood Control:** They are unable to control their moods and act inappropriately.

#### Planning Ahead

The best way to handle incapacity is to plan ahead. This involves creating legal documents that empower trusted individuals to manage your family member’s affairs if they become unable to do so themselves. Here are the key documents you need:

1. **Durable Power of Attorney (DPOA):** This document grants a trusted individual the authority to make financial and legal decisions on behalf of the incapacitated person. Unlike a regular power of attorney, a DPOA remains in effect even if the person becomes incapacitated.

2. **Healthcare Proxy or Medical Power of Attorney:** This document designates a person to make medical decisions for the incapacitated individual. This person will advocate for their healthcare preferences, from life-sustaining treatments to everyday medical care.

3. **Living Will:** A living will outlines the person’s wishes for medical treatments and interventions. It provides guidance to healthcare providers, ensuring that their preferences for end-of-life care and other critical decisions are respected.

4. **HIPAA Authorization:** Without explicit permission, even family members may not have access to medical information. A HIPAA authorization ensures that the designated decision-makers can access the information they need to advocate for the person’s care.

5. **Revocable Living Trust:** A living trust can safeguard assets during the person’s lifetime and ensure they are managed according to their wishes if they become incapacitated. This tool simplifies the management of finances and reduces the potential for court intervention.

#### Creating a Comprehensive Plan

To create a comprehensive plan, you should work with an elder care attorney who specializes in incapacity planning. They will help you draft legally sound documents tailored to your specific needs.

1. **Choose the Right People:** Select individuals who understand your family member’s values and have the judgment to act in their best interest. This could be a spouse, child, or another trusted family member or friend.

2. **Detail Instructions:** Include detailed instructions in the documents about how incapacity is determined. This can be done through a Disability Panel or a letter from a doctor, ensuring that the process is private and family-oriented.

3. **Funding the Trust:** A common pitfall is failing to fund the trust. This means retitling assets like real estate, bank accounts, and investments in the name of the trust. Without proper funding, families may face complicated, lengthy, and costly probate court proceedings.

4. **Navigating Systems:** When a person becomes incapacitated, there are two primary areas that must be managed: medical and caregiving matters, and financial matters. Successor Trustees, Agents under a Durable Power of Attorney for Property (DPA), and Health Care Agents must deal with complex systems and large bureaucracies.

5. **Seeking Legal Advice:** If someone becomes incapacitated and you are the trustee or agent under a Durable Power of